reverse tax calculator nj

See the article. This app is especially useful to.

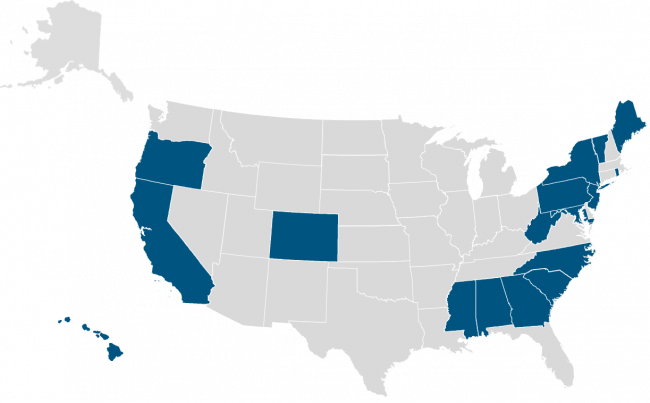

State Taxes And 1031 Exchange 2020

The average cumulative sales tax rate in the state of new jersey is 663.

. The most populous location in new jersey is newark. You can use our New Jersey Sales Tax Calculator to look up sales tax rates in New Jersey by address zip code. After 1996 several provinces adopted HST a combination of PST and GST into a single value-added tax.

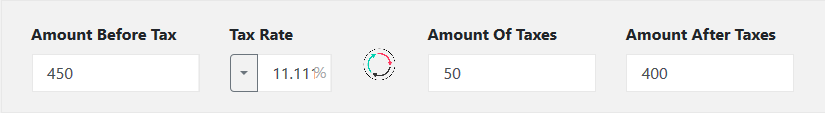

The calculator will show you the total sales tax amount as well as the. If you want to know how much an item costs without the sales tax you might want to calculate reverse sales tax. Current HST GST and PST rates table of 2022.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. See screenshots read the latest customer reviews and compare ratings for Reverse Tax Calculator. You can calculate the Sales Tax amount you paid employing any reverse Sales Tax Calculator sometimes called the Sales Tax deduction calculator or using a.

Reverse Tax Calculator is a simple financial app that allows you to quickly and easily figure out just how much of that sales total was actually taxes. Your average tax rate is 1198 and your marginal tax. Here is how the total is calculated before sales tax.

On March 23 2017 the Saskatchewan PST as raised from 5 to 6. Amount without sales tax qst rate qst amount. If you make 70000 a year living in the region of New Jersey USA you will be taxed 12783.

Have you ever wondered how much you paid for an item before the sales tax or if the sales tax on your receipt was correct. Calculate Reverse Sales Tax. US Sales Tax calculator Sales Tax calculator New Jersey.

Reverse tax calculator nj Saturday May 7 2022 Edit. Sales tax in the New Jersey is fixed to 6625. Taxjar State Sales Tax Calculator Sales Tax Tax Nexus General Tax Settings Adobe Commerce 2 4 User Guide.

Download this app from Microsoft Store for Windows 10 Windows 81 Windows. Find your New Jersey combined state. New Jersey Income Tax Calculator 2021.

The GST rate was decreased from 7 to 5 between 2006 to 2008. Now you can find out with our Reverse Sales Tax Calculator Our. You can always use Sales Tax.

This app is especially useful to all manner. The base state sales tax rate in New Jersey is 6625. To make things simple you can also depend on the reverse percentage calculator.

X 100 Y result. Tax rate for all canadian remain. New Jersey assesses a 6625 Sales Tax on sales of most tangible personal property specified digital products and certain services unless specifically exempt under New.

Reverse Tax Calculator is a simple financial app that allows you to quickly and easily figure out just how much of that sales total was actually taxes. Local tax rates in New Jersey range from 000 making the sales tax range in New Jersey 663.

Reverse Sales And Use Tax Audits The Most Frequently Asked Questions

Sales Guide Tax For Digital Goods

Salt Cap Repeal Salt Deduction And Who Benefits From It

Can The Irs Take Or Hold My Refund Yes H R Block

Sales Tax Reverse Calculator Internal Revenue Code Simplified

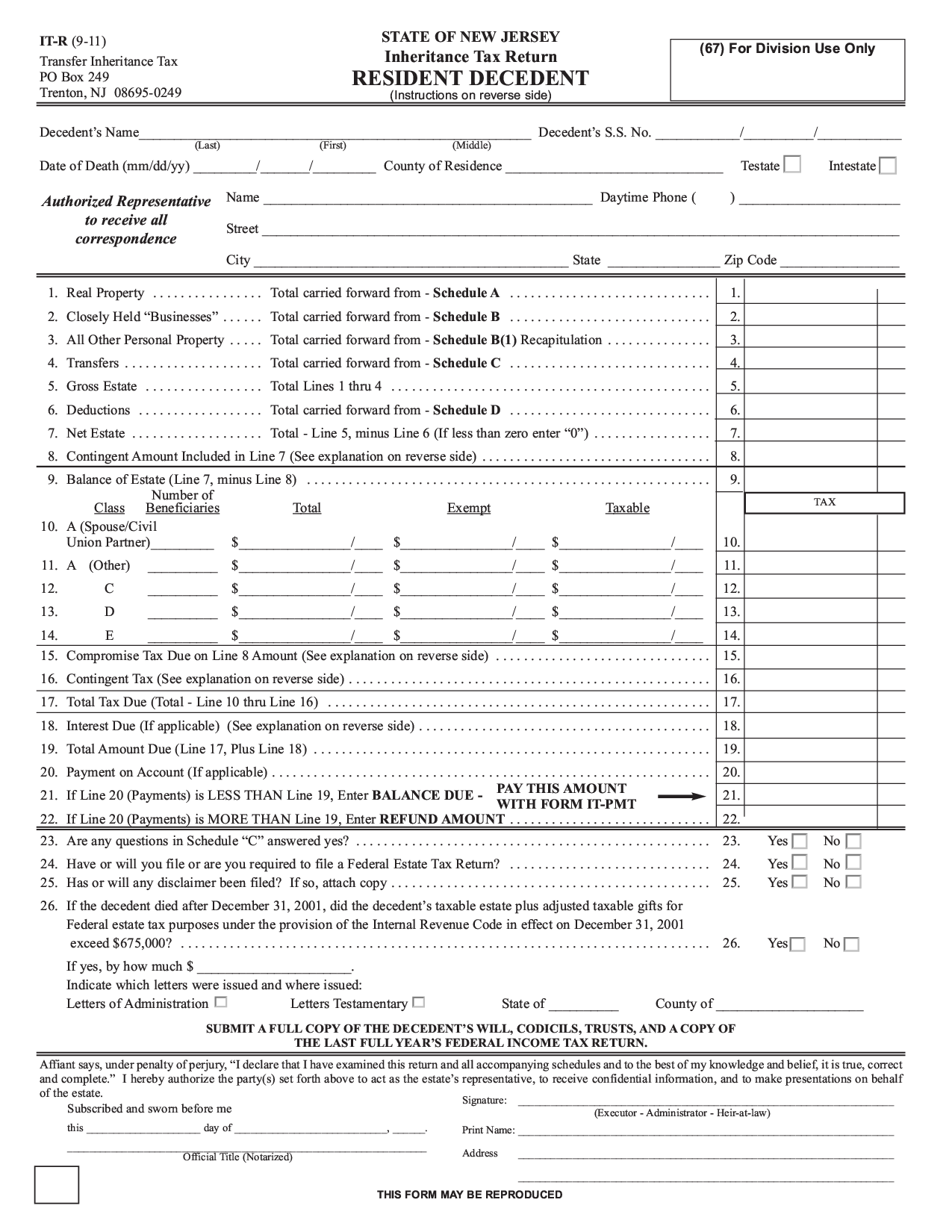

New Jersey Inheritance Tax Professional Thorpeforms

Us Sales Tax Calculator Reverse Sales Dremployee

New York State Income Tax Compared To New Jersey Income Tax

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

New Jersey Sales Tax Rate Rates Calculator Avalara

How To Calculate Sales Tax In Excel

Jumbo Reverse Mortgage Archives Far Wholesale

/cdn.vox-cdn.com/uploads/chorus_asset/file/22441883/SALT_tax_deduction_poll_Data_for_Progress.png)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

Quarterly Tax Calculator Calculate Estimated Taxes

Database Will Your Ny School Taxes Rise This Year Check Here

Tax Calculator Estimate Your Income Tax For 2022 Free